That's TAX, spelled:

B - O - H - I - C - A

Let's begin with some history to add

solid context to the approach of this subject:

Matthew 17: 24

- And when they were come to Capernaum, they that received

tribute money came to Peter, and said, Doth not your master pay tribute?

Matthew

17: 25

- He saith, Yes. And when he was come into the house, Jesus

prevented him, saying, What thinkest thou, Simon, of whom do the kings

of the earth take custom or tribute? of their own children, or of

strangers?

Matthew

17: 26 - Peter saith unto him, of strangers, Jesus

saith unto him, Then are the children free.

Right on!

Right on!

Are

you a stranger or one of the children?

Welcome Suckers, er, uh, potential

Customers. My apologies, I didn't mean to act like

a retailer.

After 30 years

of the study of law, I’ve determined

much of our

daily lives is based on fraud, misrepresentation and extortion, not to

mention hearsay, lots and lots of hearsay. I don't know about you

but I don't like being lied to or ripped off. That's

pretty much what this web site is devoted to, exposing lies and fraud.

And there's plenty to expose.

But one example should

suffice; sales tax.

If you didn't "have to" pay sales

tax, would you? If there was no

law requiring you to pay sales tax would you still pay it just because

the retailer says you have to or insists you have to if you want to

leave with the merchandise you hauled up to check out?

- YOU HAVE

TO PAY SALES TAX WHEN

YOU BUY SOMETHING OTHER

THAN FOOD! -

Everybody

believes they have to pay sales tax when they buy something other than

food at the grocery store. This belief is not supported by

fact. The

belief is false. There is NO LAW that requires the customer

to pay

sales tax. That may be hard to believe but it's true.

The customer

has to pay sales tax is the prevailing belief. People also have a

reasonable belief that the cashiers they

meet when making purchases are competent and know the rules related to

their job. Why would the thought cross the mind of the

customer that

the retailer would lie about the debt the retailer agreed to pay as a

condition

of getting their business license. Why would it cross the

customer’s mind

that the retailer would lie about the law?

Everyone who buys anything believes they are

required to pay sales

tax. However this belief is not based in fact.

The same everyones

who believe they “have to” pay sales tax have never seen the rules

regarding who “has to” pay it. If everyone did they

wouldn’t believe

what they currently believe.

The prevailing belief is predicated on fraud and

deception and the

unwary customer is subjected to extortion to ice the cake.

How did you become liable

(obligated) for

sales tax? How did you come to “have to” pay sales

tax? How would you feel if you learned that the

RETAILER and NOT THE CUSTOMER is required by law to pay sales tax?

If you believe you HAVE TO pay

sales tax then how did that “obligation” come into being?

If it’s the LAW then have you read the law? Have you seen

the law? Or have you “heard” that you “have to” pay sales

tax? Hearsay is less reliable than personal

knowledge.

Q:

Who’s got motive to lie about sales tax?

A:

Retailers.

Why? Because of the

way the LAW is written. The LAW imposes an obligation to

pay sales tax on the retailer, not the consumer. The

retailer is required BY LAW to pay sales tax. Unless the

consumer consents to pay the retailer’s tax obligation the retailer has

no authority to FORCE or COMPEL the consumer to pay their tax

obligation. In fact, in California the retailer is NOT

REQUIRED to collect sales tax.

A finding of willful fraud must be based on evidence that is clear and convincing and free from ambiguity.

Podlasky v. Price (1948) 87 Cal.App.2d 151

Owen v. McDonald (1950) 96 Cal.App.2d 65

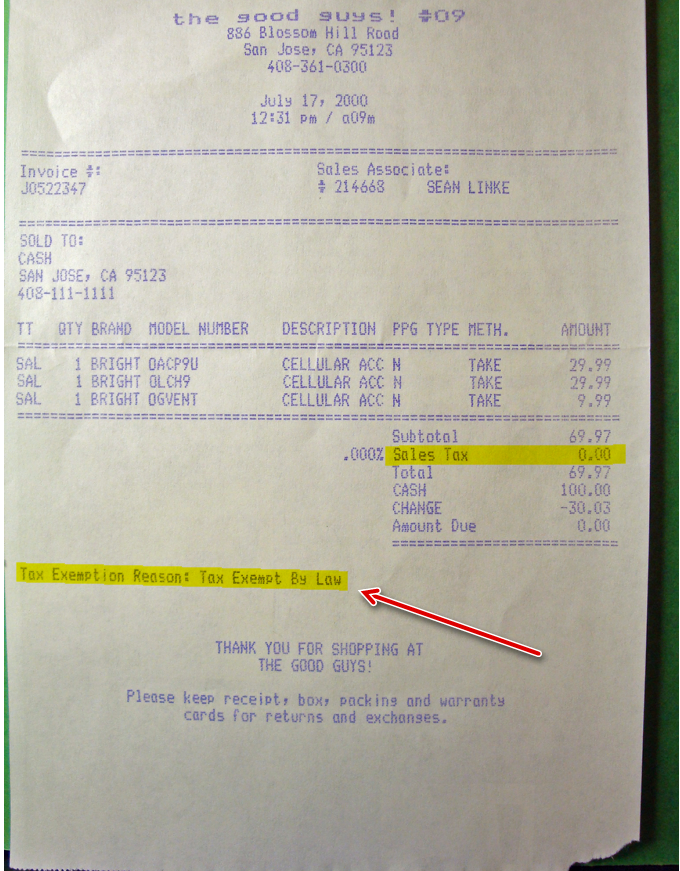

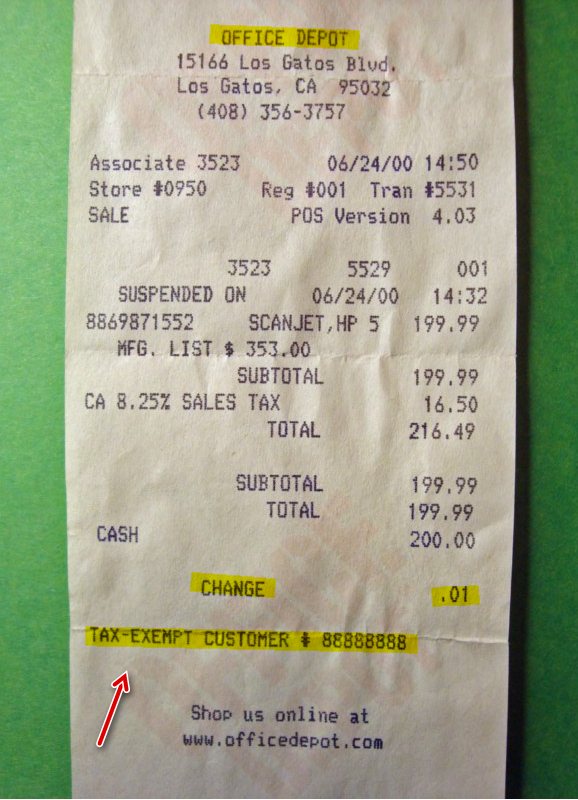

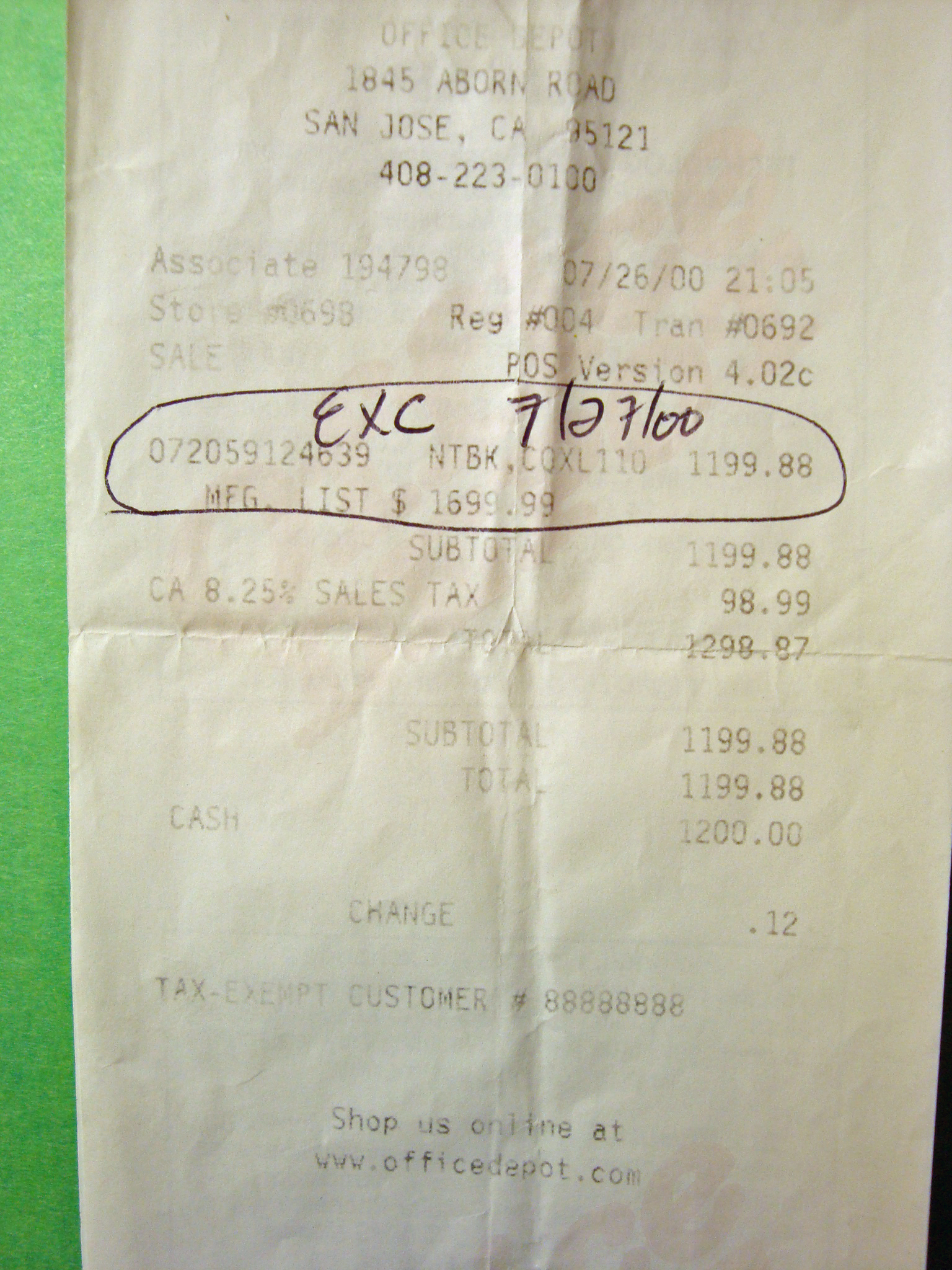

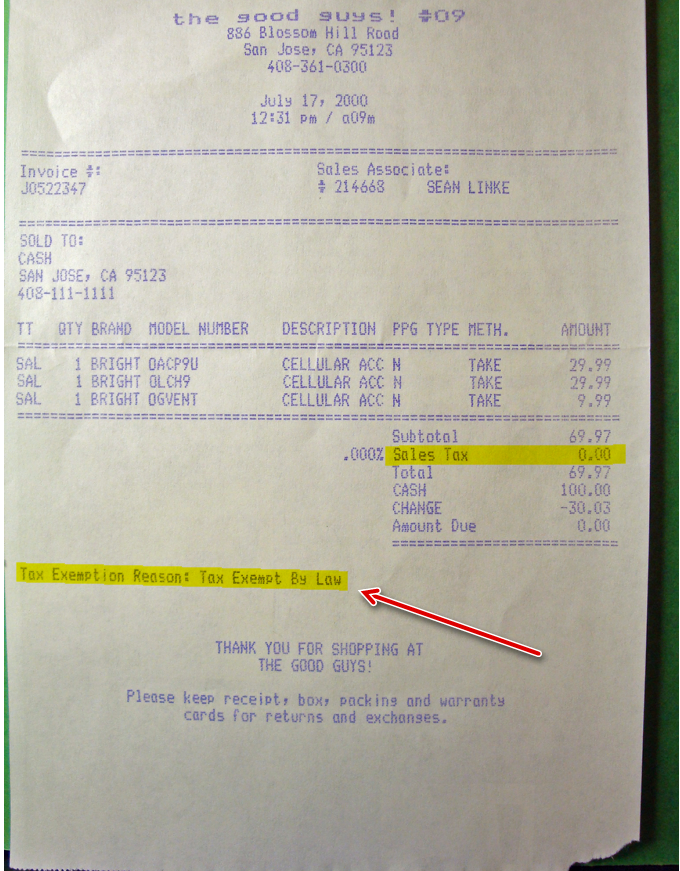

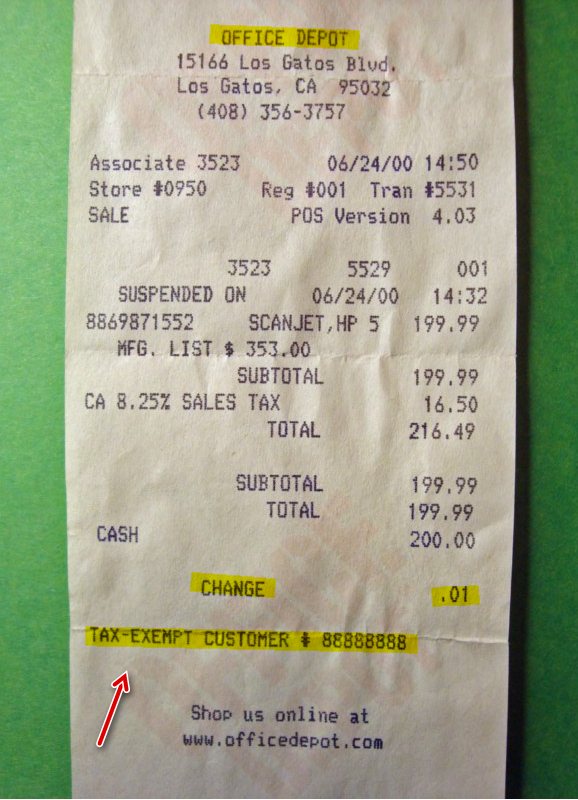

Fortunately for everyone the laws

or rules having to do with sales tax are written so people can see them

and KNOW about tax instead of GUESSING about tax. In 2000

I found the rules that apply to sales tax and read them. Then I

went out into the retail world and I applied them correctly and this

resulted in my successful presentations of the LAW to the store mangers:

That's

correct. I purchased a lap top computer and DID NOT PAY any sales

tax and saved just under $100 by applying the law.

That's

correct. I purchased a lap top computer and DID NOT PAY any sales

tax and saved just under $100 by applying the law.

Consider for a moment you never

had one minute of contract law

nor were you taught ANYTHING about tax, except you "have to pay" it and

then your tax "education" was further reinforced by the ye olde adage:

"There's nuthin sure cept death and taxes.". Well

guess what?!

Half that equation isn't true. I've proven it to myself and you

can

prove it to your own satisfaction if you want. So again, if you

didn't "have to" pay sales tax, would you? Again, if so maybe

your

time would be better spent moseyin along and finding something of

greater value or benefit to invest your time cuz what you're gonna see

is the TRUTH about sales tax and to whom it applies. HINT:

If your

status when you walk into a place like Office Depot doesn't begin with

the letter R, then there's NO OBLIGATION imposed on you to pay the

tax.

Did you know, there's only TWO

types of tax? There's many names for them but only TWO

types: DIRECT

and INDIRECT. What follows is what you, and everyone else

were never taught about...

EXCISE.

An inland imposition, paid sometimes upon the consumption of the

commodity and frequently upon the retail sale.

1 Bl. Comm. 318; Story. Const. § 950.

The

words "tax" and "excise," although often used us synonymous, are to be

considered as having entirely distinct and separate significations,

under Const. Mass. c. I, § I, art, 4. The former is a

charge apportioned either among the whole people of the state or those,

residing within certain districts, municipalities, or sections.

It is required to be imposed, so that, if levied for the public

charges of government, it shall be shared according to the estate, real

and personal, which each person may possess; or, if raised to defray

the cost of some local improvement of a public nature, it shall he

borne by those who will receive some special and peculiar benefit or

advantage which an expenditure of money for a public object may cause

to those on whom the tax is assessed. An excise, on the other

hand, is of a different character'. It is "based on no rule

of apportionment or equality whatever. It is a fixed,

absolute, and direct charge laid on merchandise, products, or

commodities, without any regard to the amount of property belonging to

those on whom it may fall, or to any supposed relation between money

expended for a public object and a special benefit occasioned to those

by whom the charge is to be paid. 11 Allen, 268.

In

English law. The name given to the duties or taxes laid on

certain articles produced and consumed at home, among which spirits

have always been the most important; but, exclusive of these, the

duties on the licenses of auctioneers, brewers, etc., and on the

licenses to keep dogs, kill game, etc., are included in the excise

duties. Wharton.

Black’s Law Dictionary,

1st Ed, 1891, p. 452, 453

Labor has been held not to be a commodity. Rohlf v. Kasemeier,

140 Iowa 182, 118 N.W. 276, 23 L.R.A., N.S., 1285. But it

has been held that the supplying of telephone service is the supplying

of a commodity of commerce; McKinley Telephone Co.

v. Cumberland Telephone Co., 152 Wis. 359, 140 N.W. 38, 39.

There is neither a DIRECT nor INDIRECT

TAX on one’s labor because your

labor (the exertion of your energy), is not a COMMODITY. Res ipsa

loquitur, your labor can not be taxed due to the way the rules

of taxation have been written.

The law, in fact all six of them

(they’re actually code

sections that reflect the law: statute which is the law), that identify

who is REQUIRED

to pay sales tax, provides in all six sections WHO is required to

pay the tax and none of them

contain the term “customer” or “consumer”. The sales tax is

the

obligation of the retailer. They agreed to pay it as a

condition of

getting their license to sell merchandise at retail. In other words, if people wanted to know

if they “had to” pay

sales tax the rules are there for them to inspect 24 hours a day 7 days

a week if they have a computer and internet access because the rules

are posted on-line for all to see.

Unless you're a retailer, paying sales tax is ludicrous!

Unless you're a retailer, paying sales tax is ludicrous!

That's

because they agreed to pay it as a condition of getting their business

license.

A finding of willful fraud must be based on evidence that is clear and convincing and free from ambiguity.

Podlasky v. Price (1948) 87 Cal.App.2d 151

Owen v. McDonald (1950) 96 Cal.App.2d 65

Ever wonder where this idea of TAX came from?

Was it a discovery or an invention? Is it like a

plant or rock or somethin found in nature? In fact what in

nature represents whatever TAX means?

Ever wonder why you

"have to" pay sales tax? Would you pay it if you didn't

"have to"? Have you ever seen the rules (law) regarding SALES

TAX? If not then how do you know for a fact you're

required to pay it? Consider for a moment who has the most

to lose, me or the retailer? Why would I tell you you didn't

have

to pay sales tax? What do I get out of it? The

retailer doesn't want you to know because they'll lose customers if it

gets out they're cheating. I'll show you where to look for the

rules about sales tax, will the retailer's you give your hard earned

dollars to do that for you?

If you've never SEEN the rule

(law)

regarding SALES TAX then all you have to base your belief on is

HEARSAY. Presumptively whomever told you about SALES TAX read

the rule (law) about it. If they didn't then they told you

HEARSAY because they only HEARD you "have to" but have never verified

that in fact you, or they, actually do. Well, you don't know me

and you don't know the retailer or the cashier byy your going to give

the cashier you don't know the benefit of the doubt they're not lying

to you or cheating you. Are they getting your money ETHICALLY?

Are you an INFORMED CONSUMER who knows about the

fundamentals of a retail transaction like who is REQUIRED to pay the

tax you believe you "have to pay". So which one of us has

the most to lose by me informing you you're NOT REQUIRED to pay sales

tax? I'm not demanding or asking you for money, they are,

and they won't let you have what you used your time and fuel to go get.

How much

would you save every month if you didn't "have to" pay sales tax?

And yearly? Permit

me to help with a quick analysis. You more than likely did

business with one or more of these retailers in the past year:

WHY BUCK TRADITION? JUST PAY IT!

A finding of willful fraud must be based on evidence that is clear and convincing and free from ambiguity.

Podlasky v. Price (1948) 87 Cal.App.2d 151

Owen v. McDonald (1950) 96 Cal.App.2d 65

Every single one of them ripped

you off, INCLUDING GAS STATIONS! GAS STATIONS ARE RETAILERS!

Even though they're different

retailers they all have the same thing in common, they SELL stuff.

Remember, we're referring to a SALES tax, it's a tax on GETTING

RID OF STUFF, not ACQUIRING STUFF. It's a tax on the exercise of

the PRIVILEGE of getting rid of stuff.

All the ones who

advertise they pay the sales tax are acting like they care about you

and what's in your wallet. They're ACTING AS IF they're doing

you a

big fat favor by paying the SALES TAX. THEY'RE REQUIRED TO

PAY THE SALES TAX so all they're "advertising" is a REQUIREMENT IMPOSED

ON THEM BY LAW WHILE MISLEADING YOU AND YOUR FAMILY AND FRIENDS IN THE PROCESS.

Do you have a reasonable

expectation the cashier's are competent and know their job and the law that applies to their job?

Do you have a

reasonable expectation they'll comply with the law? Do you

have a reasonable expectation they won't mislead you? If the

cashiers don't know what you're

about to find out then what are they doing working the register?

What are they doing handling money? And IF they do

know are they just waiting for you to simply speak up and tell em

you're not required to pay? Is it their job to tell you how to

spend your money or what the rules are? Is that what Wal-Mart

and TARGET have evolved into, business schools?

Here's the

deal with every single retailer referred to above:

YOU DID NOT OWE

THEM ONE PENNY IN

SALES TAX! YOU GAVE THEM WHAT YOU WERE UNDER NO

OBLIGATION TO

GIVE AND THEY COULD NOT FORCE YOU TO PAY IT! THEY'RE NOT

EVEN ENTITLED TO IT!

AND THEY CAN NOT PROVE YOU HAVE TO PAY IT!

Sales

tax is laid solely on retailer and not on consumer, tax relationship is

between retailer only and state,

and is direct obligation of retailer.

Livingston Rock &

Gravel Co. v De Salvo (1955, 2nd Dist) 136 Cal App 2d 156

And if that's not plain or

contemporary

enough here's a cite from a California Supreme Court case from 2014:

Plaintiffs

are consumers who contend that defendant retailer represented that it

properly was charging and in fact charged them sales tax reimbursement

on sales of hot coffee sold "to go," when, according to plaintiffs, the

tax code rendered such sales exempt from sales tax. They

brought an action against defendant retailer under two consumer

protection statutes, seeking a refund of the assertedly unlawful

charges, damages, and an injunction forbidding collection of sales tax

reimbursement for such sales. The trial court sustained

defendant's demurrer without leave to amend, and the Court of Appeal

affirmed, concluding that plaintiffs' action was not authorized under

the tax code and was barred by article XIII, section 32 of the

California Constitution. That provision limits the manner

in which taxpayers may seek a refund of taxes from the taxing entity.

We

affirm the judgment of the Court of Appeal, although our analysis

differs somewhat from that court's analysis. We conclude

that the tax code provides the exclusive means by which plaintiffs'

dispute over the taxability of a retail sale may be resolved and that

their current lawsuit is inconsistent with tax code

procedures. As explained, the consumer protection statutes

under which plaintiffs brought their action cannot be employed to avoid

the limitations and procedures set out by the Revenue and Taxation Code.

The

tax code provides that the retailer is the taxpayer and that it is the

retailer which is required to pay sales tax to the state; the

retailer is permitted but not required to collect a matching "sales tax

reimbursement" from consumers.

Loeffler v. Target Corp.

(2014), 58 Cal.4th 1081,

Download the California Court of Appeals and California Supreme Court decision in the Loeffler

matter and read them for yourself. The women who filed this

case LOST before they even left their homes to go file it. THE

DID NOT READ THE RULES! They wasted a lot of paper and ink not to

mention all their time. And consider that every time they

LOST and appealed, "We the people..." HAD TO PAY TO DEFEND AGAINST

THESE IDIOTS! They filed a LOSING CASE and "We the people..." had

to pay all the court employees involved. All over a few

cents for a couple cups of coffee.

This legal

maxim is the reason Loeffler's case was doomed from launch:

Volunti

Non Fit Injuria

He who consents cannot receive

an injury.

2 Bouv. Inst. n.

2279, 2327; 4 T. R. 657; Shelf. on mar. & Div. 449

These people deserve The A+ For

Effort trophy. That's the ONLY redeeming aspect of what they

did. That was one Herculean effort in waste of time and they

couldn't have succeeded more gracefully. They permitted

both the Court of Appeals and the Supreme Court of California to

adeptly

inform the People just exactly what one would need or want to know

about that daily occurance: SALES TAX. By telling us what

the sales tax is all about it provides us with the opportunity to find

out who acts according to the law and who doesn't. It

provides us with an opportunity to know who's telling the truth and

who's lying or misleading. Those cheats up there should

know better. And who's lower than a food seller? They're

taking advantage of most

fundamental human requirements. Why should we be tolerant of

their intolerance demonstrated toward their customers? Why

should we excuse them misleading us while it puts ill-gotten gains in

their pockets? Is it really a good business practice to

reward ignorance or bad behavior? Where's the remorse for

misleading the customer, the very people who make it possible for the

merchant and their staff to live somewhere and buy food and go on

holiday? Everything else these morons in the theeLoeffler

case did was LOSE from the gate. This thing was a complete

waste of tax dollars and the pin heads who conducted this time and

money wasting charade ought to be imprisoned for their criminal

tardness. There has NEVER been any disagreement in ANY

court case since the first one regarding the WHO in the equation of

"having to" pay sales tax. From the first to this last

successful outing of snatching defeat from a two day old child, it's

been the PRIVILEGE HOLDER; the RETAILER.

My God what an abject waste, with

a couple exceptions that are actually pretty good. People NOW

have TWO cases on the same topic that affects them EVERY TIME they make

a purchase, and that informs them with plain unambiguous language and

absolutely stunningly accurate previous court citations on the same

topic so they can be better prepared when heading out to the Retail

Forrest to bag some game, or get some game bagged if you prefer.

The appellate and Cal Sup Ct ruling are very valuable and beneficial

from the stand-point of bona fide, credible, pretty much squeaky clean

mind sets on the issue. Bottom line, the rulings are really good

and well worth studying until the information becomes a part of

your Retail Financial Transaction Mode-O-Operandi.

Anyway, I

think the idea is: Why reward a cheat?!

They rip you off because you

don't know the rules. They rip you off because they can.

Call em on it and see what happens. Show em the rules and see if

they're honest or not. See if they'll treat you like you're

outta your mind. They also "double dip". In addition to

them expecting you to pay their sales tax, they also get the PROFIT

MARGIN between what they actually pay for the items and what they're

offered for. The MSRP, is merely a "SUGGESTED", price.

The manufacturer is just tryin to be helpful to the retailers by

providing a guestimate of what uninformed customers might be willing to

pay. So profit margin and sales tax, is there anything else?

Yup! You know those convenience card swipe machines

with the buttons no one seems to know how to properly push nor the

sequence to use to "pay" for the shit they want? Those things

are RENTED by the retailer. Guess who picks up the tab for the

convenience of the card swipers? The cash users and everyone

else.

When

did merchants become special and not have to pay their way like

everyone else? How come they get to pass on their rent to

the customer but the customer can't demand the retailer pay some of

theirs?

Anyone got a bug?

NOT CAL WORTHINGTON TOO?!?!?!?!

Man

I'm sure that's worth every penny of the amount the sucker, er,

customer pays in sales tax. One

should pay a little extra

for a status symbol.

"Everybody

knows" the customer "has to" pay sales tax. Just kidding.

But it sure adds up doesn't it?!

"Everybody

knows" the customer "has to" pay sales tax. Just kidding.

But it sure adds up doesn't it?!

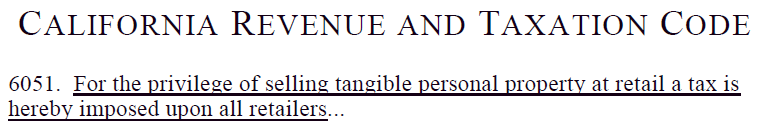

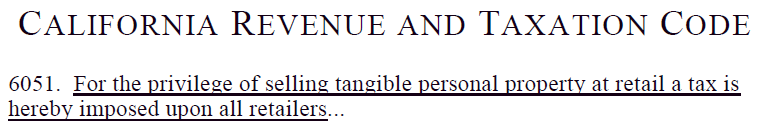

What

evidence would you need to see before you believed that you, as the

customer, are NOT required to pay Sales Tax? The law maybe?:

The word "customer" is NOWHERE to be

found in that

section or the other 5 sections that contain the same exact words you

see there. Notice that it's a

"privilege" to sell tangible personal property at retail.

The privilege is commercial in nature. Everybody

knows that "driving is a privilege", and that they have to have a

license to drive. The similarity between the two seemingly

dissimilar activities is that they're both "commercial privileges", or

one might say the license issued to both the retailer and driver

permits valid engagement in commercial transactions related to their

respective business, one selling the other delivering.

The TYPE

of tax on the retailer is no different than the tax imposed on someone

with a driver license. Like selling tangible personal

property at retail, driving is a business, or job, or occupation, and

the driver an employee. So again, what evidence would you need

to see in

order to be convinced that you, as customer, are NOT REQUIRED to pay

sales tax unless you agree to do so?

So consider this scenario in

relation to the SALES

TAX you believe you're required to pay even though you've never seen

the rules. Let’s say I move into the apartment next to you or

the house next to yours. Let’s say rent or mortgage payment

day rolls around and you get a knock at your front door.

You check it out and it’s me. Then you hear this:

Hi, I need you to cut

me a check in the amount of $2800.

What might

your reaction be?

You what?!

I need you to cut me a check in the

amount of $2800.

I don’t understand.

Well I have to pay rent today so I need a

check for $2800.

You signed a rental agreement right?

Yeah.

Well what are you doing here?

Like I said I need you to cut me a check

in the amount of $2800 so I can pay rent.

You do realize that you agreed to pay

rent as a condition of getting the apartment right?!

Yeah.

Then paying the rent is your

responsibility.

I know, but you’re gonna pay it.

Gonna cut me a check?

Didn't think so, so why

do you cut the retailer a check, it's the same thing. They

agreed to pay the SALES TAX as a condition of qualifying for the

license, then when they sell an item and are required to pay the tax on

it, they trick you into paying what they agreed to pay. Me

stopping by asking for a check for my rent payment will result in a

door being slammed in my face for being a dumb ass, however the

retailer will be rewarded for their deception. In fact, it's my

experience those retail professionals don't even know any of this.

So if you don't have to then why do you let those people who

need you to buy the shit on their shelves or they're gonna starve and

not be able to make any payments for anything deceive you into

believing something that's patently false? I don't think it's

good business to reward fraud and extortion.

Paying

$ale$

TAX

Is

Like

Yeah, I suppose ya can, but

why would you when your nose works perfectly well without the nail in it?

A finding of willful fraud must be based on evidence that is clear and convincing and free from ambiguity.

Podlasky v. Price (1948) 87 Cal.App.2d 151

Owen v. McDonald (1950) 96 Cal.App.2d 65

WHY ARE THEY ACTING "AS IF" THEY'RE DOING THEIR

PATRONS/CUSTOMERS/CONSUMERS A FAVOR?

WHY ARE THEY MAKING A

BIG DEAL OUT OF DOING WHAT THEY AGREED TO DO?

We clean the floors

We clean the restrooms

We pay our employees

The store manager opens the store in the morning

We lock the door when we close

The store manager uses a key to unlock the door in the

morning

We sell merchandise

Without electricity we can't run our business efficiently

We agreed to pay sales tax as a condition of qualifying

for the business license

WHY ARE THEY

REPRESENTING BY IMPLICATION THE PATRON/CUSTOMER/CONSUMER IS "OBLIGATED"

TO PAY SALES TAX?

They're misleading for MONEY.

They're misleading for MONEY.

They want to SPEND LESS of it on CUSTOMERS.

They save money, and now make money, by selling bags.

They reduced the "cost of doing business" by not buying bags to give

away to their customers.

The MOTIVE is MONEY.

How they get it is by DECEPTION.

Decptive business practices are not only unlawful but are

also unethical.

BOTTOM LINE: The

retailer is REQUIRED BY LAW to pay sales tax. The customer IS

NOT

REQUIRED to pay sales tax. There is NO LAW requiring the

customer to

pay sales tax. I've have unassailable evidence the CUSTOMER

IS NOT

REQUIRED TO PAY SALES TAX.

I

made the law work. I didn't "practice" anything, I applied the

law

properly and the right someone did nothing more than comply with the

law.

THE

$ALE$ TAX FRAUD

fraud

: the crime of using dishonest methods to

take something valuable from another person

: a person who pretends to be what he or

she is not in order to trick people

: a copy of something that is meant to look like the real thing in

order to trick people

Full Definition of fraud

1 a: deceit, trickery;

specifically: intentional perversion of

truth in order to induce another to part with something of value or to

surrender a legal right

b: an act of deceiving or misrepresenting: trick

2 a: a person who is not what he or she

pretends to be: impostor;

also: one who defrauds: cheat b: one that is

not what it seems or

is represented to be

n.

the intentional use of deceit, a trick or some dishonest means to

deprive another of his/her/its money, property or a legal right.

A

party who has lost something due to fraud is entitled to file a lawsuit

for damages against the party acting fraudulently, and the damages may

include punitive damages as a punishment or public example due to the

malicious nature of the fraud. Quite often there are several

persons

involved in a scheme to commit fraud and each and all may be liable for

the total damages. Inherent in fraud is an unjust advantage over

another which injures that person or entity. It includes failing

to

point out a known mistake in a contract or other writing (such as a

deed), or not revealing a fact which he/she has a duty to communicate,

such as a survey which shows there are only 10 acres of land being

purchased and not 20 as originally understood. Constructive

fraud can

be proved by a showing of breach of legal duty (like using the trust

funds held for another in an investment in one's own business) without

direct proof of fraud or fraudulent intent. Extrinsic fraud

occurs

when deceit is employed to keep someone from exercising a right, such

as a fair trial, by hiding evidence or misleading the opposing party in

a lawsuit. Since fraud is intended to employ dishonesty to

deprive

another of money, property or a right, it can also be a crime for which

the fraudulent person(s) can be charged, tried and convicted.

Borderline overreaching or taking advantage of another's naiveté

involving smaller amounts is often overlooked by law enforcement, which

suggests the victim seek a "civil remedy" (i.e., sue). However,

increasingly fraud, which has victimized a large segment of the public

(even in individually small amounts), has become the target of consumer

fraud divisions in the offices of district attorneys and attorneys

general.

See also: constructive fraud

exemplary damages extrinsic fraud fraud in the

inducement fraudulent

conveyance intrinsic fraud

An assertion or

manifestation by words or conduct that is not in accord with the facts.

Misrepresentation

is a tort, or a civil wrong. This means that a misrepresentation can

create civil liability if it results in a pecuniary loss. For example,

assume that a real estate speculator owns swampland but advertises it

as valuable commercially zoned land. This is a misrepresentation. If

someone buys the land relying on the speculator's statement that it is

commercially valuable, the buyer may sue the speculator for monetary

losses resulting from the purchase.

To

create liability for the maker of the statement, a misrepresentation

must be relied on by the listener or reader. Also, the speaker must

know that the listener is relying on the factual correctness of the

statement. Finally, the listener's reliance on the statement must have

been reasonable and justified, and the misrepresentation must have

resulted in a pecuniary loss to the listener.

A

misrepresentation need not be intentionally false to create liability.

A statement made with conscious ignorance or a reckless disregard for

the truth can create liability. Nondisclosure of material or important

facts by a fiduciary or an expert, such as a doctor, lawyer, or

accountant, can result in liability. If the speaker is engaged in the

business of selling products, any statement, no matter how innocent,

may create liability if the statement concerns the character or quality

of a product and the statement is not true. In such a case, the

statement must be one of fact. This does not include so-called puffing,

or the glowing opinions of a seller in the course of a sales pitch

(such statements as "you'll love this car," or "it's a great deal").

A

misrepresentation in a contract can give a party the right to rescind

the contract. A Rescission of a contract returns the parties to the

positions they held before the contract was made. A party can rescind a

contract for misrepresentation only if the statement was material, or

critical, to the agreement.

A

misrepresentation on the part of the insured in an insurance policy can

give the insurer the right to cancel the policy or refuse a claim. An

insurer may do this only if the misrepresentation was material to the

risk insured against and would have influenced the insurer in

determining whether to issue a policy. For example, if a person seeking

auto insurance states that she has no major chronic illnesses, the

insurer's subsequent discovery that the applicant had an incurable

disease at the time she completed the insurance form probably will not

give the insurer the right to cancel the auto policy. However, if the

person was seeking Health Insurance, such a misrepresentation may

justify cancellation of the policy or a denial of coverage. Generally,

cancellation or denial of insurance coverage for a misrepresentation

can occur only if the insurance applicant was aware of the inaccuracy

of the statement.

Further readings

Kionka, Edward J. 1988. Torts. St. Paul, Minn.: West.

Cross-references

Consumer Protection; Product Liability; Sales Law; Tort Law.

West's Encyclopedia of American Law, edition 2. Copyright

2008 The Gale Group, Inc. All rights reserved.

http://legal-dictionary.thefreedictionary.com/Misrepresentation

misrepresentation

Fraudulent,

negligent, or innocent misstatement, or an incomplete statement, of a

material fact. If a specific misrepresentation induces the other party

to enter into a contract, that party may have the legal right to

rescind the contract or seek compensation for damages. The guilty party

avail of the defense that the wronged party could have checked the

facts and have discovered what was wrong. A misstatement of an

intention or opinion is generally not considered a misrepresentation.

Misrepresentation

in general is a legal term that means "a false statement of fact that

has the effect of inducing someone into a contract." For example,

telling someone a stereo is "practically new" so that they buy it, when

it is in fact 5 years old and heavily used.

Negligent

misrepresentation is one of the three recognized varieties of

misrepresentations in contract law (along with innocent and fraudulent

misrepresentation). Basically, it means that you did not directly lie

(say something you KNOW to be false), but you made a representation

about something while having no reasonable reasons for believing it to

be true, such as when Sygenta claimed that its GMO corn could be sold

in all major markets for American-grown corn.

Example:

A real estate broker tries to sell a house to a buyer, who stresses his

need for peace and quiet. The broker promises that the house is very

quiet. In reality, the house next door is undergoing a very noisy

reconstruction. Although the broker did not know this, her promise that

the house was quiet was made without her having any reason to believe

that that was the case. She simply assumed it. This would be a

negligent misrepresentation (had she known about the construction and

lied about it, however, that would be a much more serious fraudulent

misrepresentation).

What Constitutes Negligent

Misrepresentation?

The essential elements of a

claim of negligent misrepresentation are:

Someone made a false representation as to a past or

existing fact.

Statements about the future do not count, nor do opinions or typical

"car-salesman" type phrases ("This is a great car," "This is a real

deal," and the like).

The person

making the belief must have no reasonable ground for believing it to be

true. So in the real estate broker example, if the broker had lived in

the house for 10 years, and always found it to be quiet in the past,

then her misrepresentation would not have been negligent (in that case

it would have been an innocent misrepresentation).

The representation must have been made with the

intent to induce

the other party to rely upon it. Basically, you had to be using your

misrepresentation in order to help you make the deal.

The other party must have believed the

misrepresentation and

reasonably relied on it. Most courts are hesitant to protect a buyer if

he is unreasonable in relying on whatever the seller told him (for

example, in trying to sell him a car, the seller assured him it could

go "a million miles an hour," and the buyer believes this). The buyer

must also rely partly (or in many courts, wholly), on the

misrepresentation in deciding to go ahead with the transaction.

As a result of the reliance on the

misrepresentation, the other

party suffered damages. This means the buyer must be actually harmed by

the final transaction, otherwise there is no liability.

There

is an important distinction to be made here, however. The more serious

variety of misrepresentation (fraudulent misrepresentation, or fraud),

has nearly identical elements, so the line between the two is very

fine. The only difference is that fraudulent misrepresentation requires

“reckless disregard” as to the truth of something”, while negligent

disregard only requires “no reasonable ground” to assume something is

true. It is essentially a matter of degree.

So

in the real estate broker example, for instance, it was not a reckless

disregard for the truth to say the house was quiet, since many homes

may be considered so, even if it was negligent of her as a broker to

discover this fact before making any claims.

But

if the buyer had said “I am deathly allergic to common pine wood, is

there any pine wood in this house?” and she had responded “no, not at

all” when in fact she has no idea what kind of wood the house is made

of, then this would be a reckless disregard for the truth of something,

especially considering the possibly consequences.

Remedies for Negligent Misrepresentation

Misrepresentations

are civil offenses, meaning you can only sue for them in civil court

(the criminal equivalent of these offenses is called "false

pretenses"). The general remedy in civil court for all types of

misrepresentations is that of rescission. This means the court will act

like the transaction or contract never existed, and everyone goes back

to the way they were.

Example: You sell

someone a stereo for $50 telling them that it is fully functional

(which you think is true), and it turns out to be broken. The deal is

rescinded; the buyer returns the stereo, and you return the money.

However,

negligent misrepresentation is aptly named, as it requires negligence

(which is by itself a separate civil offense) on the part of the

perpetrator. It is therefore considered a more serious offense than

mere innocent misrepresentation, and can have its own separate set of

remedies under the tort of negligence. See that article for more

details.

A

false statement of fact made by one party which affects the other

party's decision in agreeing to a contract. If the misrepresentation is

discovered, the contract can be later declared void and the situation

remedied if the party who relied on the misrepresented fact files suit.

For this reason, it is important to be accurate when disclosing facts

relevant to a contract negotiation.

Misrepresentation

generally applies only to statements of fact, not to opinions or

predictions. In some situations, such as where a fiduciary relationship

is involved, misrepresentation can occur by omission. That is,

misrepresentation may occur where a fiduciary fails to disclose

material facts of which he or she has knowledge. A duty also exists to

correct any statements of fact which later become known to be untrue.

In this case, failure to correct a previous false statement would be

misrepresentation.

THE

LAW OF TORTS

by

William L. Prosser

Professor of Law

Hastings College of the Law

FOURTH EDITION

HORNBOOK SERIES

WEST PUBLISHING CO.

1971

p. 143

NEGLIGENCE

§30. ELEMENTS OF CAUSE OF

ACTION

Negligence,

as we shall see, is simply one kind of conduct. But a cause

of action

founded upon negligence, from which liability will follow, requires

more than conduct. The traditional formula for the elements

necessary

to such a cause of action may be stated briefly as follows:

1. A duty or obligation,

recognized by the law, requiring the

actor to conform to a certain standard of conduct, for the protection

of others against unreasonable risk.

2. A failure on his part to

conform to the standard required.

These two elements go to make up what the courts usually have called

negligence; but the term quite frequently is applied to the second

alone. Thus it may be said that the defendant was

negligent, but is

not liable because he was under no duty to the plaintiff not to be.

3. A reasonable close casual

connection between the conduct and

the resulting injury. This is what is commonly known as

“legal cause”

or “proximate cause”.

4.

The

actual loss or damage resulting to the interests of

another. Since

the action for negligence developed chiefly out of the old form of

action on the case, it retained the rule of that action, that proof of

damage was an essential part of the plaintiff’s case.

Nominal

damages, to vindicate a technical right, cannot be recovered in a

negligence action, where no actual loss has occurred. The

threat of

future harm, not yet realized, is not enough. Negligent

conduct in

itself is not such an interference with the interests of the world at

large that there is any right to complain of it, or to be free from it,

except in the case of some individual whose interests have

suffered.

Such a statement must, however, be qualified to the extent that, as in

the case of other torts, where irreparable injury is threatened, a

court of equity may act by injunction to prevent the harm before it

occurs. Even here the damage, even though only potential,

is the

basis for granting relief.

Chapter 18

REMEDIES FOR MISREPRESENTATION

§105, p. 691

Estoppel

Still another form in which misrepresentation may

play an important part in the law of torts is that of

estoppel. An estoppel is a rule which precludes a party

from taking a particular legal position because of some impediment or

bar recognized by the law.82 It was applied originally to

prevent a party from challenging the validity of a legal record, or his

own deed; but the equity courts developed it later as a general

principle, used as a means of preventing him from taking an inequitable

advantage of a predicament in which his own conduct had placed his

adversary. It was taken over in turn by common law judges,

as a device to lengthen their arm, and afford a relief which equity had

always offered.83 Such equitable estoppel, or as it is

often called, estoppel in pais, has been defined as “an impediment or

bar, by which a man is precluded from alleging, or denying, a fact, in

consequence of his own previous act, allegation or denial to the

contrary.84

82.

“‘Estoppel’ cometh from the French word estoupe, from whence the

English word stopped; and it is called estoppel, or conclusion, because

a man’s own act, or acceptance, stoppeth or closeth up his mouth to

allege or plead the truth.” Co.Litt. 352a. It was one

time regarded as a rule of pleading, or of evidence; but since it goes

to the position taken upon the merits, it is clearly a rule of

substantive law. Williston, Liability for Honest

Misrepresentation, 1911, 24 Harv.L.Rev. 415, 425.

83.

Bacon, V. C., in Keate v. Phillips, 1881, 18 Ch. Div. 560,

577. The leading case in which the principle of estoppel is

fully recognized at law is Pickard v. Sears, 1837, 6 Ad. & El. 469,

112 Eng.Rep. 179.

84. 2 Jacob, Law Dictionary, 1811, 439; Ewart,

Principles of Estoppel, 1900, 4.

Negligence

A representation made with an honest belief in its

truth may still

be negligent, because of lack of reasonable care in ascertaining facts,

or in the manner of expression, or absence of the skill and competence

required by a particular business or profession.

Id. §107, Negligence,

p. 704

Fraud comes in TWO flavors: ACTUAL

&

CONSTRUCTIVE. The former means INTENTIONAL and the latter

means NOT ON PURPOSE. Either way, if you wind up on the short

end of the stick by the REPRESENTATION MADE then you're DAMAGED and the

other party OWES YOU. Even if they "didn't mean to" to

misrepresent or lie, you're still DAMAGED. Your

"interest" in hearing TRUTH or ACCURATE REPRESENTATIONS upon which

your purchasing decision is based is adversely affected when what you

hear is flat out wrong. And again, either way, you wind up on the

suffer end of the bargain.

These are the rules provided by the Legislature

regarding who is REQUIRED to pay sales tax:

CALIFORNIA

REVENUE AND TAXATION CODE

6051.

For the privilege of selling tangible personal property at retail

a tax is hereby imposed upon all retailers...

6051.1. (a)

Notwithstanding Section 6051, for the privilege of

selling tangible personal property at retail a tax is hereby imposed

upon all retailers ...

6051.2. (a) In addition

to the taxes imposed by Section 6051 and any

other provision of this part, for the privilege of selling tangible

personal property at retail, a tax is hereby imposed upon all retailers

at the rate of 1/2 percent of the gross receipts of any retailer from

the sale of all tangible personal property sold at retail in this

state on and after July 15, 1991.

6051.3. In addition to

the taxes imposed by Sections 6051, 6051.2,

6051.5, and any other provision of this part, for the privilege of

selling tangible personal property at retail, a tax is hereby imposed

upon all retailers...

6051.5. (a)

In addition to the taxes imposed by Section 6051 and any other

provision of this part, for the privilege of selling tangible personal

property at retail a tax is hereby imposed upon all retailers at the

rate of one-quarter of 1 percent of the gross receipts of any retailer

from the sale of all tangible personal property sold at retail in this

state.

6051.7. (a) In addition to

the taxes imposed by Section 6051 and any other provision of this part,

for the privilege of selling tangible personal property at retail, a

tax is hereby imposed upon all retailers...

Excise tax

Federal or state tax placed on the sale or

manufacture of a commodity, typically a luxury item e.g., alcohol.

http://financial-dictionary.thefreedictionary.com/Excise+Duties

EXCISE. An inland

imposition, paid sometimes upon the consumption of the commodity, and frequently

upon

the retail sale. 1 Bl.Comm. 318; Patton v. Brady, 184 U.S. 608,

22 S.Ct. 493, 46 L. Ed. 713; Portland Bank v. Apthorp, 12 Mass. 256.

An excise has been defined as meaning tribute, custom, tax, tollage, or

assessment, a fixed absolute and direct

charge laid on merchandise, products, or commodities without any regard

to amount of property belonging to

those

on whom it may fall, or to any supposed relation between money expended

for a public object and a special benefit occasioned to those by whom

the charge is to be paid. In re Opinion of the Justices, 282 Mass. 619,

186 N. E. 490, 491.

An excise is an impost for a license

to pursue certain callings or to deal in special commodities or

to exercise

particular franchises. East Ohio Gas Co. v. Tax Commission of Ohio,

D.C.Ohio, 43 F.2d 170, 172

BLACK'S LAW DICTIONARY,

4th Ed., 1951, p. 672

[color and italics supplied]

I

deliver flowers for a living. I work for FTD Florist. I

qualified by having a clean driving record and a valid California Class C driver

license.

PASSENGER (customer) DELIVERY SERVICE

PASSENGER (customer) DELIVERY SERVICE

QUALIFICATION FOR EMPLOYMENT: Clean Driving Record & a valid

Class C driver license.

YOO HOO! I'd like to

engage in a commercial transaction with you Mr. Transportation Business

Service Provider Employee.

We're

doin some business here see?! Yeah, we flagged down this here

ice cream truck. It's just business see?! What's it to ya

anyhow?! You got the wrong buncha guys. We was just

wantin an ice cream bar mister, honest. We didn't mean

nuthin by it. No foolin.

Nice

doin business with you Mr. Ice Cream Retailer Man with a license to

legally move your retail establishment around town while legally

operating your retail frozen milk product distribution business.

Our dentist said to keep up the good work. Seeya tomorrow.

Brusha brusha brusha, with the new Ipana.

Presumptively people are aware

the Legislature makes the rules

that apply through out the state. Well the rules they

provided

regarding the sales tax impose it on the retailer, not the

customer.

So the customer will have to determine whether they’re being defrauded

or deceived or mislead or not and whether they’re being subjected to

extortion (If you don’t pay the tax we won’t sell you the

merchandise!). In other words the retailer will refuse to

complete

the transaction if you don’t consent to do what you aren’t required to

do. In other words, unless you agree to do what you aren’t

required

or want to do, they will refuse to complete the sale.

Again, people have a reasonable

belief that the cashiers they

meet when making purchases are competent and know the rules related to

their job. Refuse to pay the sales tax and watch what

happens in

spite of the foregoing laws and court rulings.

A finding of willful fraud must be based on evidence that is clear and convincing and free from ambiguity.

Podlasky v. Price (1948) 87 Cal.App.2d 151

Owen v. McDonald (1950) 96 Cal.App.2d 65

What you're about to see is EVIDENCE OF WILLFUL (actual - intentional) FRAUD:

“... YOUR SALES TAX...”

“...your sales tax...”

“...your sales tax...”

Those

are EXPRESS representations. There is nothing vague or

ambiguous.

There is nothing implied. Those two retailers have clearly

and

expressly asserted the sales tax is the customer’s

obligation. Those

two representations are TRUE or FALSE, there’s no middle

ground.

That’s FALSE ADVERTISING or it’s not.

...sales tax is imposed on

retailer for privilege of selling tangible personal property,...

Bank of

America Nat'l Trust & Sav. Asso. v State Board of Equalization

(1962, 1st Dist) 209 Cal. App.2d 780

It is well established – indeed, appellant concedes – that

the tax is imposed on the retailer and not the consumer.

Pac.

Coast Eng. Co. v. State of California (1952) 111 Cal.App.2d 31

The

sale tax provisions create a relation of sovereign power and taxpayer

between the state and retailer and not between the state and the

consumer.

Western

Lithograph Co. v State Board of Equalization (1938) 11 Cal. 2d

156

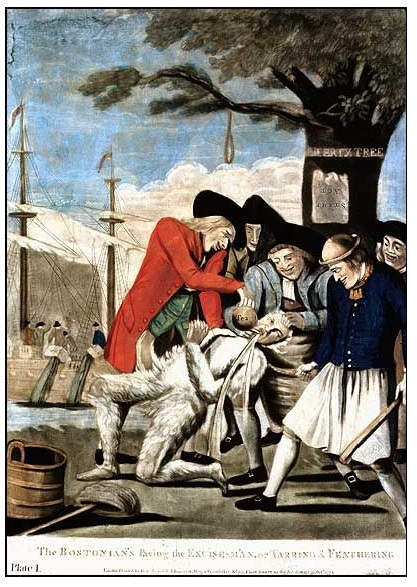

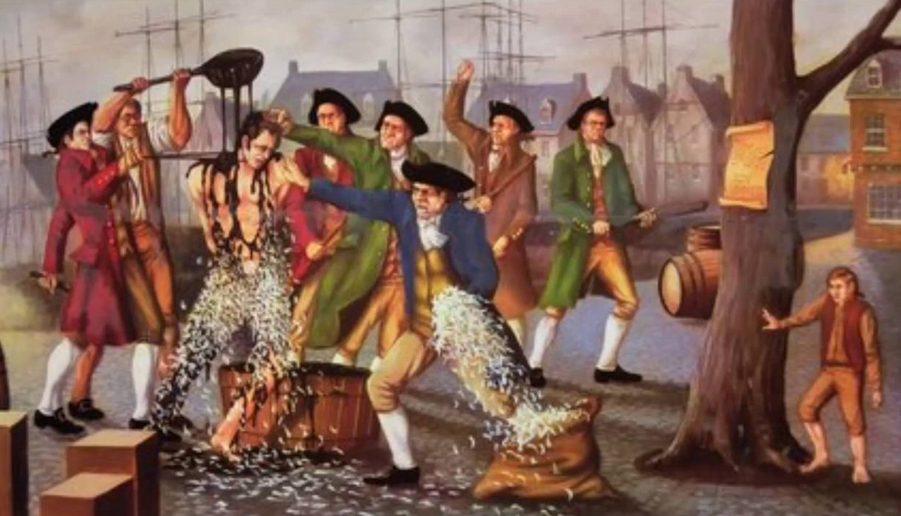

What people used to do to The Excise

Man.

The Hills Of Connemara

Gather up the pots and the old tin can

The Hills Of Connemara

Gather up the pots and the old tin can

And the mash, and the corn, the barley, and the bran

And then run like the devil from the excise man

Keep the smoke from rising, Barney

Now keep your eyes well peeled today

The tall, tall men, they're on their way

They're searching for the mountain tea

In the hills of Connemara

Gather up the pots and the old tin can

And the mash, and the corn, the barley, and the bran

And then run like the devil from the excise man

Keep the smoke from rising, Barney

A gallon for the butcher and a quart for Tom

And a bottle for the poor old Father Tom

To help the poor old dear along

In the hills of Connemara

Gather up the pots and the old tin can

And the mash, and the corn, the barley, and the bran

And then run like the devil from the excise man

Keep the smoke from rising, Barney

Now swing to the left, now swing to the right

Sure, the excise man can dance all night

He's drinkin 'up the tea 'til the broad daylight

In the hills of Connemara

Gather up the pots and the old tin can

And the mash, and the corn, the barley, and the bran

And then run like the devil from the excise man

Keep the smoke from rising, Barney

Now, stand your ground, and don't you fall

The excise men, they're at the wall

Jesus Christ, they're drinkin' it all

In the hills of Connemara

Gather up the pots and the old tin can

And the mash, and the corn, the barley, and the bran

And then run like the devil from the excise man

Keep the smoke from rising, Barney

(2x)

Songwriters

PATRICK MURPHY, STEPHEN TWIGGER, SAMANTHA HUNT, STEPHEN WEHMEYER, SHEP

LONSDALE

Published by

Lyrics © BMG RIGHTS MANAGEMENT US, LLC

Excises & Snake Oil used to get

one a new suit and a free ride outta town.

Don'tcha long for the

goode olde days every now and again?

One of the other automotive

mysteries concerns the original logo adopted by the Dodge

Brothers. It resembled the traditional six-sided Jewish star, or

Mogen David. One of the more popular – though not necessarily

accurate – explanations is that it honored the Jewish bankers who were

the only ones to lend money to the new Dodge car company. They

allegedly wanted to spite the virulently anti-Semetic Henry Ford.

http://www.thedetroitbureau.com/2013/07/familiar-chevrolet-bowtie-badge-turns-100/

There's one

helluva lotta tax on a car and tires and washers and refrigerators.

Why on earth would people who knew better agree to pay the

retailer's bill when they were under absolutely no obligation to do so

unless they were independently wealthy and just didn't care?

So how much would it be worth to

you to begin your study of

this common everyday occurance to see if you can trim an unnecessary

and

wasteful expense from your already overloaded budget? How much

would

it be worth to have copies of actual receipts from national retailers

to show family and friends so everyone can begin learning how to save?

How much would it be worth to have the law and lots and

lots of

unassailable evidence of the claim being made? How many more

receipts

would you need to see in order to be convinced it's not a fluke?

There's copies of at least 7 more. You'll know the

retailers, again,

they're national, or they were. One went out of business

but they

were a major player for a time re their merchandise, audio and video,

home entertainment. You'll be provided with sections of

municipal

codes from different municipalities throughout California all saying

the same thing. All the information is unequivocal and

unassailable.

The pathetic part about this is that as many people I've told

since

2000 when I first pieced ti together, I'm only aware of TWO who've

actually managed to get themselves a receipt based on the information I

provided. Uh, a point of clarification, one didn't get a

receipt but

I have absolutely no reason not to believe them because I asked for

nothing. They paid nothing. We had no relationship.

They'd

stumbled across something of mine and contacted me and let me know they

made a purchase without paying sales tax but lost the receipt or some

such thing. The other actually was successful at Whole Foods.

I say

more power to him. Yes, he got a receipt. Yes a copy is

supplied.

Hopefully that makes for a

reasonable introduction to the topic and hopefully further

investigation

will be conducted to further verify the truth of the matter:

THE CUSTOMER IS NOT

REQUIRED

TO PAY SALES TAX

AS A CONDITION

OF A

VALID COMMERCIAL RETAIL TRANSACTION

And for those folks living in California who are bein ripped off on the

CRV bottle tax, you're not re quired to pay that either:

CALIFORNIA PUBLIC RESOURCES

CODE

DIVISION 12.1. CALIFORNIA BEVERAGE CONTAINER RECYCLING

AND LITTER REDUCTION ACT

CHAPTER 5. MINIMUM REDEMPTION VALUE

.......................... 14560 - 14562

SECTION 14560 - 14562

14560. (a) (1) Except

as provided in paragraph (3), a

beverage

distributor shall pay the department,

for deposit into the fund, a redemption payment of four cents ($0.04)

for a beverage container sold or offered for sale in this state by the

distributor.

(2) A beverage

container with a capacity of 24 fluid ounces or more shall be

considered as two beverage containers for purposes of redemption

payments and refund values.

(3) On and after July 1, 2007, the amount of the

redemption payment and refund value for a beverage container with a

capacity of less than 24 fluid ounces sold or offered for sale in this

state by a dealer shall equal five cents ($0.05) and the amount of

redemption payment and refund value for a beverage container with a

capacity of 24 fluid ounces or more shall be ten cents ($0.10), if the

aggregate recycling rate reported pursuant to Section 14551 for all

beverage containers subject to this division is less than 75 percent

for the 12-month reporting period from January 1, 2006, to December 31,

2006, or for any calendar year thereafter.

(b) Except as provided in subdivision (c), all

beverage containers sold or offered for sale in this state have a

minimum refund value of eight cents ($0.08) for every two beverage

containers redeemed and four cents ($0.04) for a single or unpaired

beverage container redeemed in a single transaction.

(c) Notwithstanding subdivision (b), a single or

unpaired beverage container of 24 fluid ounces or larger shall have a

minimum refund value of eight cents ($0.08).

(d) (1) The department shall periodically review the

fund to ensure that there are adequate funds in the fund to pay refund

values and other disbursements required by this division.

(2) If the department

determines, pursuant to a review made pursuant to paragraph (1), that

there may be inadequate funds to pay the refund values and necessary

disbursements required by this division, the department shall

immediately notify the Legislature of the need for urgent legislative

action.

(3) On or before 180 days after the

notice is sent pursuant to paragraph (2), the department may reduce or

eliminate expenditures, or both, from the fund as necessary, according

to the procedure set forth in Section 14581, to ensure that there are

adequate funds in the fund to pay the refund values and other

disbursements required by this division.

(e) This section does not

apply to a refillable beverage container.

(f) The repeal and reenactment of this section by

Chapter 815 of the Statutes of 1999 does not affect any obligations or

penalties imposed by this section, as it read on January 1, 1999.

The Legislature did not impose

any payment obligation on customers or consumers to pay the CRV,

they're rippin us off on that too. And for those of you who

live in a "YOU

HAVE TO PAY FOR A SHOPPING BAG" county, it's just an ordinance, it's

not GENERAL LAW! And it too does not REQUIRE the customer or

consumer to pay for a bag. The RETAILER "MAY" make a bag

available and charge for the bag or not, but they don't have to and the

customer or consumer isn't required to buy one.

SAN JOSE,

CALIFORNIA

San Jose, California

- Code of Ordinances

Title 9 - HEALTH AND

SAFETY

Chapter 9.10 - SOLID

WASTE MANAGEMENT

Part 13 - SINGLE-USE

CARRY-OUT BAG

Editor's note— Part

13, adopted by Ordinance 28877, adopted December 14, 2010, is effective

January 1, 2012.

9.10.2010 -

Definitions.

The definitions set

forth in this section shall govern the application and interpretation

of this Part 13.

A.

"Customer" means any person obtaining goods from a retail establishment.

B.

"Nonprofit charitable reuser" means a charitable organization, as

defined in Section 501(c)(3) of the Internal Revenue Code of 1986, or a

distinct operating unit or division of the charitable organization,

that reuses and recycles donated goods or materials and receives more

than fifty percent of its revenues from the handling and sale of those

donated goods or materials.

C.

"Person" means any natural person, firm, corporation, partnership, or

other organization or group however organized.

D.

"Prepared food" means food or beverage which is prepared on the

premises by cooking, chopping, slicing, mixing, freezing, or squeezing,

and which require no further preparation to be consumed. "Prepared

food" does not include any produce, bulk food or meat from a produce,

bulk food or meat department within a retail establishment.

E. "Public eating establishment" means a:

1. Restaurant, take-out food establishment, or any other

business, that receives ninety percent or more of its revenue from the

sale of prepared food to be eaten on or off its premises; or

2. Department, unit or section located within and operated

by a retail establishment that generates ninety percent or more of its

revenue from the sale of prepared food to be eaten on or off its

premises, and the department, unit or section does not engage in the

sale of perishable or nonperishable goods from another department, unit

or section within the same retail establishment.

F.

"Recycled paper bag" means a paper bag provided at the check stand,

cash register, point of sale, or other point of departure for the

purpose of transporting food or merchandise out of the establishment

that contains no old growth fiber and a minimum of forty percent

post-consumer recycled content; is one hundred percent recyclable; and

has printed in a highly visible manner on the outside of the bag the

words "reusable" and "recyclable," the name and location of the

manufacturer, and the percentage of post-consumer recycled content.

G.

"Retail establishment" means any commercial establishment that sells

perishable or nonperishable goods including, but not limited to,

clothing, food, and personal items directly to the customer; and is

located within or doing business within the geographical limits of the

City of San José. "Retail establishment" does not include public eating

establishments or nonprofit charitable reusers.

H.

"Reusable bag" means either a bag made of cloth or other machine

washable fabric that has handles, or a durable plastic bag with handles

that is at least two and one-quarter mil thick and is specifically

designed and manufactured for multiple reuse.

I.

"Single-use carry-out bag" means a bag other than a reusable bag

provided at the check stand, cash register, point of sale or other

point of departure for the purpose of transporting food or merchandise

out of the establishment. "Single-use carry-out bags" do not include

bags without handles provided to the customer: (1) to transport

produce, prepared food, bulk food or meat from a produce, deli, bulk

food or meat department within a store to the point of sale; (2) to

hold prescription medication dispensed from a pharmacy; or (3) to

segregate food or merchandise that could damage or contaminate other

food or merchandise when placed together in a reusable bag or recycled

paper bag.

(Ords.

28877, 29314.)

9.10.2020 -

Single-use carry-out bag.

A.

No retail establishment shall provide a single-use carry-out bag to a

customer, at the check stand, cash register, point of sale or other

point of departure for the purpose of transporting food or merchandise

out of the establishment except as provided in this section.

B.

On or before December 31, 2013, a retail establishment may make

available for sale to a customer a recycled paper bag for a minimum

charge of ten cents.

C.

Notwithstanding this section, no retail establishment may make

available for sale a recycled paper bag unless the amount of the sale

of the recycled paper bag is separately itemized on the sale receipt.

D.

A retail establishment may provide a customer participating in the

California Special Supplement Food Program for Women, Infants, and

Children pursuant to Article 2 (commencing with Section 123275) of

Chapter 1 of Part 2 of Division 106 of the Health and Safety Code; and

a customer participating in the Supplemental Food Program pursuant to

Chapter 10 (commencing with Section 15500) of Part 3 of Division 9 of

the California Welfare and Institutions Code, with one or more recycled

paper bags at no cost through December 31, 2013.

(Ords.

28877, 29314.)

9.10.2030 -

Recordkeeping and Inspection.

Every retail establishment shall keep complete and

accurate record or documents of the purchase and sale of any recycled

paper bag by the retail establishment, for a minimum period of three

years from the date of purchase and sale, which record shall be

available for inspection at no cost to the city during regular business

hours by any city employee authorized to enforce this part. Unless an

alternative location or method of review is mutually agreed upon, the

records or documents shall be available at the retail establishment

address. The provision of false information including incomplete

records or documents to the city shall be a violation of this section.

(Ord.

28877.).

That ordinance is DISCRIMINATORY.

Poor people, or people on welfare or EBT or some other

assistance program, don't have to pay.

ALAMEDA COUNTY, CALIFORNIA

ALAMEDA COUNTY, CALIFORNIA

ORDINANCE

2012-2

AN

ORDINANCE TO REGULATE THE USE OF

CARRYOUT BAGS AND PROMOTE

THE USE OF REUSABLE BAGS

The

Board of the Alameda

County Waste Management Authority (“Authority”) ordains as follows:

SECTION

1 (Enactment)

The Board of the Authority does hereby enact

this Ordinance in full consisting

of Section 1 through

Section 11.

SECTION 2 (Findings)

(a)

The purpose of this Ordinance is to reduce

the use of single use carryout bags and

promote the use of

reusable bags at

the point of sale in Alameda

County.

(b)

The Authority has the power to enact this Ordinance

pursuant to the Joint Exercise of Powers Agreement for Waste Management

(“JPA”). The JPA grants the Authority the power,

duty, and responsibility to prepare, adopt, revise, amend, administer, enforce and implement the County Integrated Waste Management Plan (“CoIWMP”), and pursuant to Section

5.m of the CoIWMP, the

power to adopt

ordinances necessary to carry out

the purposes of the JPA.

(c)

Reducing single use bag use is reasonably necessary to carry out the

purposes of the JPA

and implement the CoIWMP, including the following goals and policies.

(d)

Goal 1 of the CoIWMP is to promote environmental quality, ensure

protection of public health and safety, and to minimize environmental impacts in all aspects of solid waste management. Policy 1.4.1 includes

reduction of hard to recycle materials.

(e)

Goal 2 of the CoIWMP

calls on the Authority and its member

agencies to “achieve maximum feasible waste reduction” and to

“reduce the amount of waste

disposed at landfills through improved management

and conservation of resources.”

(f)

Policy 2.1.1 adopts

a waste management hierarchy that ranks

management of waste through source

reduction and then recycling

and composting above landfill disposal.

(g)

Goal 7 of the CoIMWP is to "Promote Inter-jurisdictional Cooperation.” Policy

7.1.3 states

that the Authority shall coordinate with other organizations as needed to fulfill

its countywide role

including coordinating on related issues

such as water and litter. Objective 7.8 states

that the Authority

will coordinate and facilitate program implementation by individual or subregional groupings of member agencies.

(h)

Numerous

studies have documented

the

prevalence of plastic carry-out bags littering the

environment, blocking storm drains and fouling beaches.

(i)

Plastic bags are a substantial source of marine debris.

(j)

Plastic bags cause

operational problems at County landfills and transfer

stations and contribute to litter countywide.

(k)

The Authority has participated in a campaign with The Bay Area

Recycling Outreach Coalition

to promote reusable bags

countywide for several years.

Despite these efforts, plastic

bags comprise 9.6% of litter collected during coastal

cleanup days (based on 2008 data)

in Alameda County. Additionally,

plastic bags continue to cause

processing equipment

problems at

County transfer stations.

(l)

There are several

alternatives to single-use carry-out bags readily available.

(m)

Studies document

that banning single use plastic

bags

and charging for single use paper bags will dramatically reduce the

single use of both types of

bags.

(n) The

Authority prepared the Mandatory Recycling and Single Use Bag

Reduction Ordinances Environmental Impact Report,

which considered two

separate

projects and included the environmental review required

by the California Environmental Quality Act

for this Ordinance. The

Authority certified those

portions of the EIR relevant to this Ordinance.

SECTION

3 (Definitions)

The definitions set forth in this Section shall govern the application and interpretation of this ordinance.

(a)

“Alameda

County” means all of the

territory located within

the incorporated

and unincorporated areas

of Alameda County.

(b)

“Authority”

means the Alameda County Waste Management

Authority created by the Joint Exercise

of Powers Agreement for Waste Management

(JPA).

(c)

“Authority Representative” means any agent of the Authority designated by the Enforcement Official to implement this Ordinance, including Member

Agency employees, or private

contractors hired for purposes of monitoring and enforcement.

(d)

"Covered

Jurisdiction" means a Member

Agency of the JPA that has not opted out of coverage

under this Ordinance pursuant to Section 9 of this Ordinance.

(e)

“Customer” means any Person obtaining goods from a Store.

(f)

“Enforcement

Official” means the Executive Director of the Authority or his or her

authorized designee.

(g)

“Executive

Director” means the individual appointed by the Authority Board to act as head

of staff and perform those duties specified by the

Authority Rules of

Procedure and by the Board.

(h)

"Member

Agency" means a party to the JPA.

Current member

agencies are the County of Alameda, the Cities of

Alameda, Albany, Berkeley,

Dublin, Emeryville,

Fremont, Hayward,

Livermore,

Newark, Oakland, Piedmont,

Pleasanton, San Leandro,

Union City, and the Castro Valley and Oro

Loma Sanitary Districts.

The service

areas for the purpose of

Section 9

of this Ordinance are:

(1)

The legal boundaries of each of the 14

incorporated

municipalities within

Alameda County.

(2)

The unincorporated sections of the County.

(i)

“Nonprofit Charitable Reuse Organization" means a charitable

organization recognized as having Section 501 (c)(3) status by the Internal Revenue Code of 1986, or a distinct

operating unit or division of the charitable organization, that reuses and recycles donated goods or materials and receives more than fifty percent

(50%) of its revenues

from the handling and sale of those donated

goods or materials.

(j)

“Person” means an individual, firm, public or private corporation, limited liability company, partnership, industry or any other entity whatsoever.

(k)

“Postconsumer

recycled material” means a

material that would

otherwise be destined

for solid waste

disposal, having

completed its intended

end use and product life cycle. Postconsumer recycled material

does not include materials

and byproducts generated from, and commonly

reused within, an original manufacturing

and fabrication process.

(l)

“Primary

Enforcement Representative” is the chief

executive of a Covered Jurisdiction

or a qualified designee who

will coordinate with the

Authority

regarding implementation

of

the Ordinance. A

qualified designee

shall have at least two years of municipal code

enforcement

experience or have undergone at least the level one

municipal code compliance

training program of the

California Association of Code Enforcement Officers, or equivalent training

program approved by

the Enforcement Official.

(m)

“Public Eating Establishment” means a

restaurant, take-out

food establishment or other business that receives 90% or more of its revenue from the sale of foods and/or drinks prepared on the premises.

(n)

"Recycled Paper Bag” means a paper bag provided

by a Store to a Customer at the check stand, cash register, point

of sale, or other location for the purpose of transporting food or merchandise out of the Store and that contains no old growth fiber and a minimum of forty percent (40%) postconsumer recycled material;

is one hundred percent (100%) recyclable and compostable, consistent with the timeline and specifications of the American Society of

Testing and Materials

(ASTM) Standard D6400; and has printed in a highly visible

manner on the

outside of the bag the words

“Recyclable,” the name

and location

of the manufacturer, and the percentage of post-consumer recycled content.

(o)

"Reusable Bag” means a

bag with handles

that is specifically designed and manufactured for multiple reuse and meets all of the following requirements: 1) has a

minimum lifetime of 125 uses, which for purposes of this

subsection, means the capability of carrying a

minimum of 22 pounds 125 times over a distance

of at least 175 feet; 2) has a minimum

volume of 15 liters; 3) is machine washable or is made from a

material that can be cleaned or disinfected; 4) does not contain lead, cadmium

or any other heavy metal in toxic amounts, as defined by applicable state and federal standards and regulations for packaging or reusable bags; 5) has printed on the bag, or on a tag that is permanently affixed to the bag, the name of the manufacturer, the location

(country) where the bag was manufactured, a statement that the bag does not contain lead, cadmium, or any other heavy metal in toxic amounts, and the percentage of postconsumer recycled material used, if any; and 6) if made of

plastic, is a minimum

of at least 2.25 mils thick.

(p)

“Single-Use Carryout Bag” means a bag other than a Reusable Bag provided at the check stand,

cash register, point of sale or other location for the purpose of transporting food or merchandise out of the Store. Single-Use

Carryout Bags do not include bags that are integral to the packaging of the product, or bags without handles provided to the Customer (i) to transport produce, bulk food or

meat from a produce, bulk food or meat department within a Store to the point of sale, (ii) to hold prescription medication dispensed from a pharmacy,

or (iii) to segregate food or merchandise that could damage or contaminate other food or merchandise when placed together in a Reusable